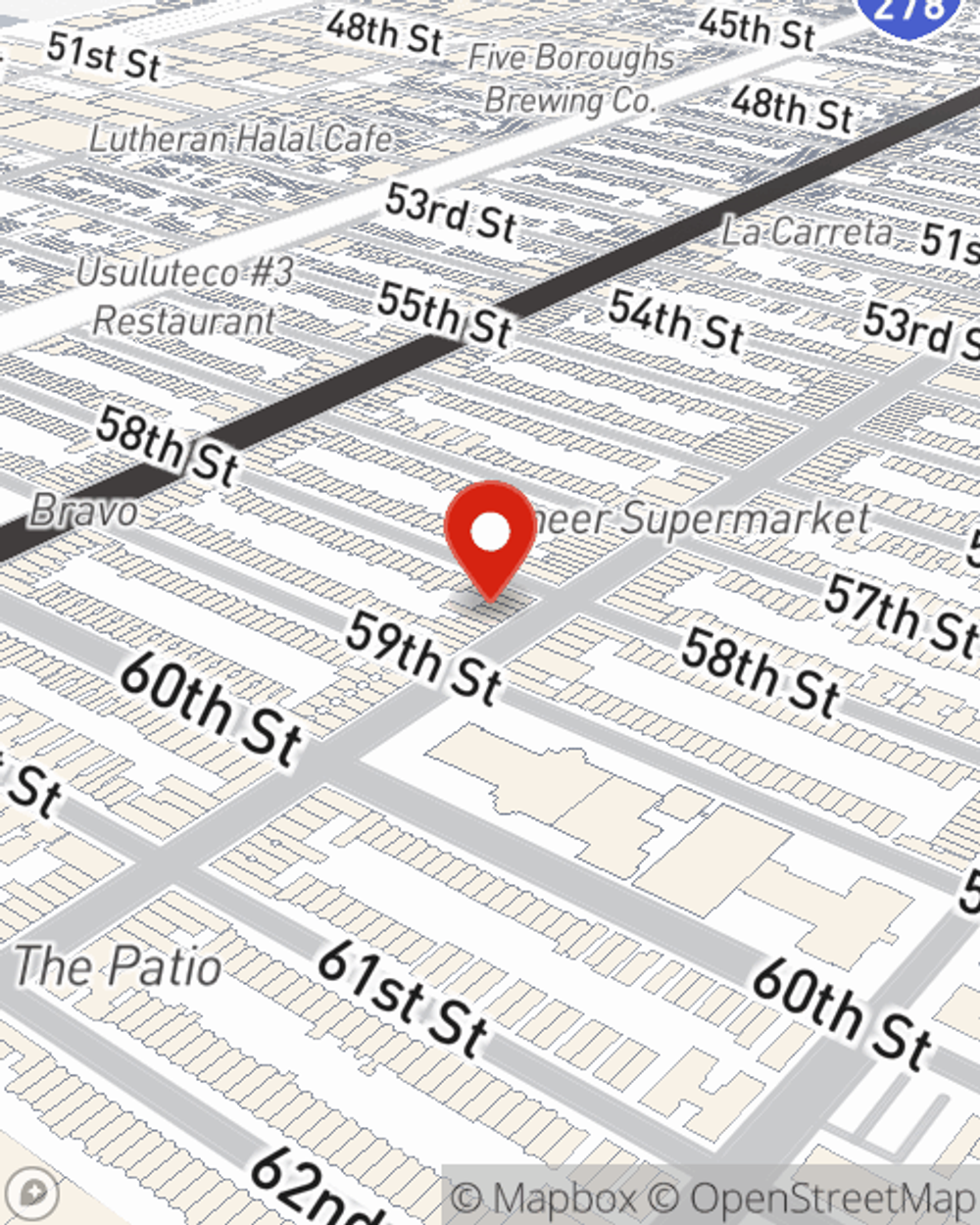

Condo Insurance in and around Brooklyn

Here's why you need condo unitowners insurance

Protect your condo the smart way

Welcome Home, Condo Owners

When it's time to laugh and play, the home base that comes to mind for you and your family and friendsis your condo.

Here's why you need condo unitowners insurance

Protect your condo the smart way

Condo Coverage Options To Fit Your Needs

We know how you feel. That's why State Farm offers outstanding Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Chris Foster is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that works for you.

When your Brooklyn, NY, townhome is insured by State Farm, even if the worst comes to pass, State Farm can help insure your property! Call or go online today and see how State Farm agent Chris Foster can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Chris at (844) 913-2886 or visit our FAQ page.

Simple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.

Chris Foster

State Farm® Insurance AgentSimple Insights®

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

A condo maintenance checklist for every season

A condo maintenance checklist for every season

Whether you rent or own a condo, it's important to pay attention to maintenance. Get your condo ready for upcoming weather with these maintenance tips.